-

Professional Expertise and Team Collaboration

Professional Expertise and Team CollaborationOur professionals, with diverse backgrounds in VC/PE, financial institutions, policy finance, securities, accounting, pharmaceuticals, and consulting, work closely together to deliver optimal results.

-

Broad Investment Positioning

Broad Investment PositioningWe actively invest across all stages of corporate growth, leveraging these experiences to establish a wide-ranging professional network.

-

Post-Management & Fund Operations Expertise

Post-Management & Fund Operations ExpertiseWe are establishing a solid track record in stable fund management, grounded in our expertise in portfolio construction and exit strategies aligned with the characteristics of each investment asset and fund.

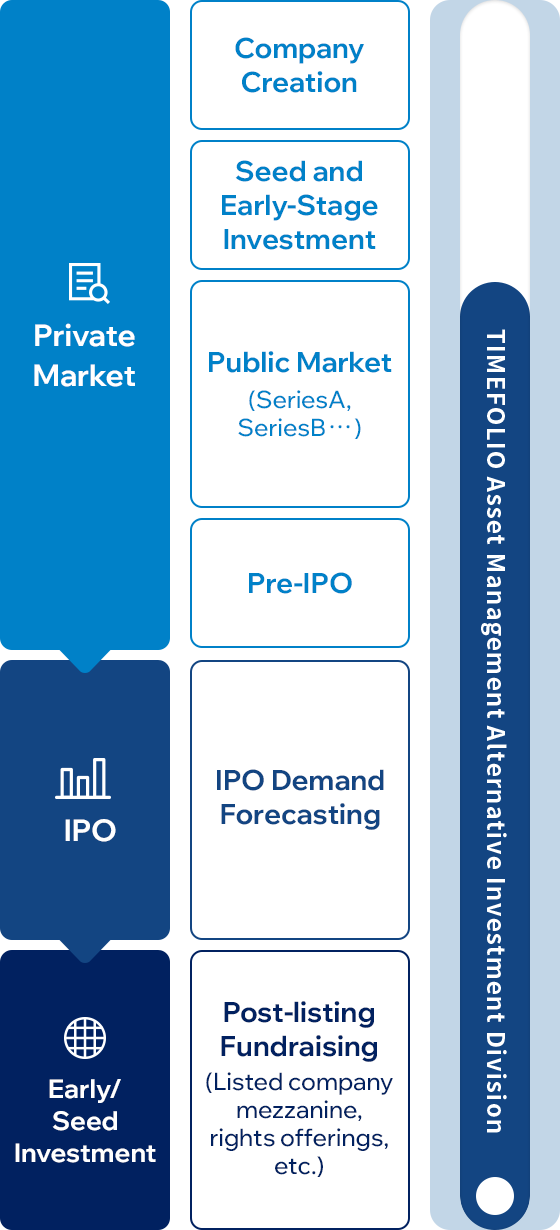

Covering most areas of corporate growth stages

Possessing investment capabilities and experience in most areas of private/public markets

Based on industry-specific expertise and strategic partnerships, we conduct investments across the entire corporate lifecycle.

-

Private Companies

Investment in Promising Private Companies – Primary & Secondary Shares

Leveraging extensive experience from multiple portfolio company IPOs, we provide value-up support and demonstrate strong collaboration with diverse stakeholders in the private market. -

Listed Company Mezzanine

CB, BW, and Preferred Equity Investments in KOSPI & KOSDAQ Listed Companies

Rigorous Risk Management for Downside Protection and Proactive Issue Prevention -

IPO Public Offerings

IPO Bookbuilding Participation for Newly Listed Companies

Management of Fund Vehicles with Preferential IPO Allocation, Including KOSDAQ Venture and High-Yield Funds -

LP Investments

Investment in Blind Funds and Project Funds

Creating Operational Synergies through Active Collaboration with Fund GPs and Other LPs -

Other Strategies

Management of Diverse Strategies Including Structured Finance and Block Deals

Providing Tailored Solutions and Block Trading of Listed Company Shares