TIMEFOLIO Hedge Funds

One Step Ahead,Smarter Investing

TIMEFOLIO Asset Management anticipates market trends and responds ahead of the curve. We convert market change into opportunity through disciplined, research-driven strategies.

Long/Short

Global Macro /

Event Driven

Multi-Manager

Strategy (MMS)

for diversified alpha sources

Proprietary In-House Investment Technology Platform

Flexible Long / Short Strategies

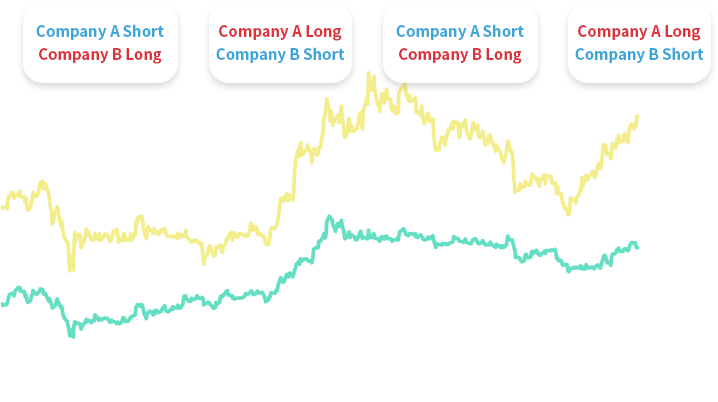

Through long/short strategies, we aim to generate alpha, reduce volatility, and respond swiftly to fast-moving markets.

![]() This chart is for illustrative purposes only and does not represent an actual investment case.

This chart is for illustrative purposes only and does not represent an actual investment case.

- Company A

- Company B

Companies with durable competitive advantages

Market leaders

Companies resilient to negative news and responsive to positive catalysts

Companies with structural or persistent disadvantages

Index futures (market hedge)

Companies vulnerable to negative news and unresponsive to positive developments

Event Driven Strategies

we swiftly identify market shifts and proactively seek profit opportunities.

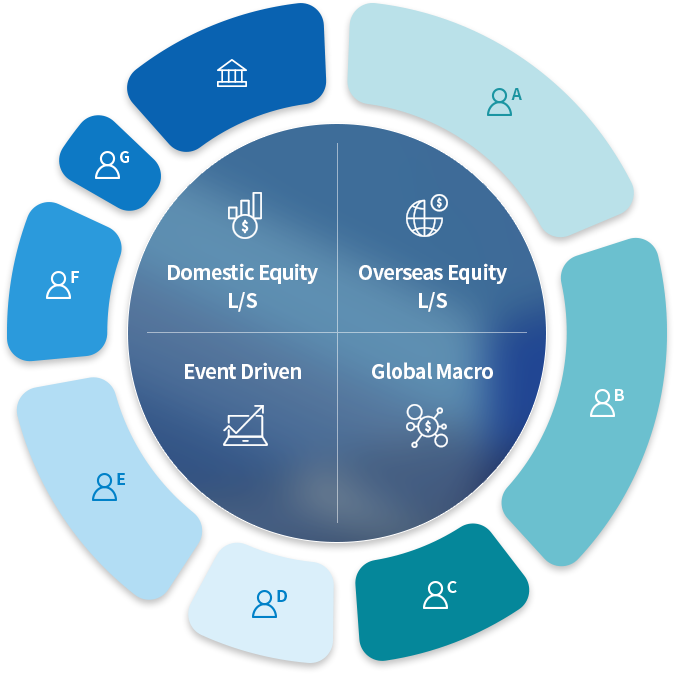

Independent portfolio managers run distinct strategies,

with results integrated into a single fund

— TIMEFOLIO’s differentiated multi-manager system.

Alternative Investment Division

Alternative Investment Division Equity Managers

Equity Managers

-

01

Transparent performance evaluation with a merit-based compensation framework for each portfolio manager.

-

02

Mitigation of key-person risk associated with star portfolio managers.

-

03

Scalable structure designed to support growing assets under management.

-

04

Synergies among strategies and enhanced portfolio diversification.

A disciplined pursuit of long-term, stable performance.

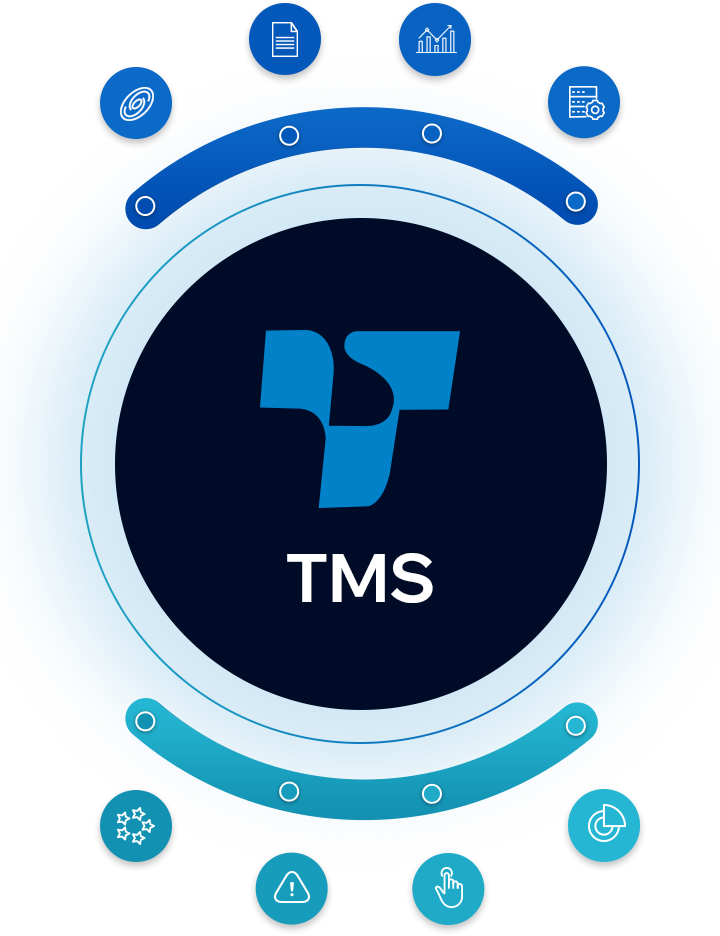

Enhanced Efficiency with TMS

Our proprietary management platform, TMS, supports multi-manager strategies

and enables stable, efficient management by conducting risk and cost assessments in advance.

-

- Universe Selection

- Historical validation of key fundamental

and technical variables

-

- Scoring

- Individual equity analysis incorporating fundamentals,

valuation, and supply–demand factors.

-

- Data Analysis Tools

- Consensus tracking, estimate, and style analysis

-

- Data Systematization

- Integration of quantitative and qualitative analysis

within an in-house research database.

-

- Portfolio Management

- Pre-trade risk and compliance checks,

plus sector management by each portfolio manager

-

- Order System

- Proprietary order-management system

and cross-portfolio order netting

-

- Risk Management

- Risk-limit controls by manager and product,

with automated breach detection

-

- Performance Review

- Return-risk analysis by portfolio manager,

including asset-allocation and equity-selection effects